This is how we get your unpaid invoices paid

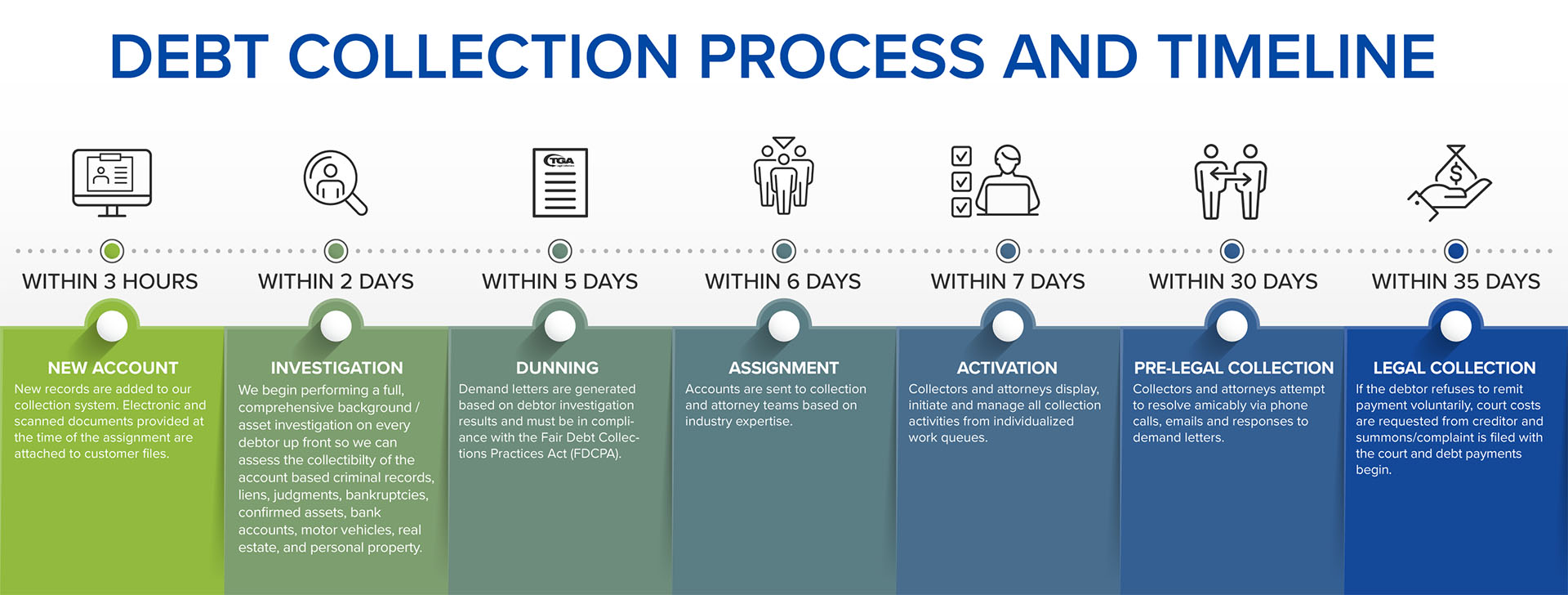

Upon receipt of your collection placement file(s), we enter the information into our collection system. Simultaneously we generate a demand letter that is sent to the debtor/defendant to inform them that our firm has been retained and we now represent you. In our demand letter we use certain disclaimers to be compliant with the Fair Debt Collection Practices Act (FDCPA). This dunning letter gives the debtor an opportunity to respond within 30 to 45 days to dispute. Our firm is also making collection phone calls to the debtor in attempt to resolve amicably as well as running a full comprehensive background and asset investigation. Our comprehensive investigation provides us with information indicating the financial stability the debtor may or may not have.

In other words, our firm will know if the debtor has a bank account, has a W2 employer, owns an automobile, owns a home, etc. More importantly, we will also know whether or not our debtor has previous judgments as well as liens, criminal records, etc. If we do not receive a response from the debtor via our demand letters, emails, and voicemails, we then will evaluate if the debtor is suit worthy based on certain criteria. One of those criteria is to determine if the debt is collectible based on our full comprehensive background and asset investigation on our subject.

The end result is that we will know for certain whether or not the debtor has the ability to make payment. Our full comprehensive background and asset investigations provide us with an extremely accurate profile of the subject debtor. Another criteria is, the amount of the debt that is outstanding. Our office typically recognizes $500 as the threshold amount in which we will file suit, as under $500 is not economically feasible as there are court costs to proceed with litigation. On accounts under $500 we will continue to run demand letter campaigns as well as settlement offer campaigns to encourage the debtor to pay by offering a small discount. Simultaneously we are continuing to make phone calls as well as emails to the debtor to encourage payment.

The reason our collection firm leads the country in collecting on sued accounts is simple: Once we sue an account and the debtor is effectively served, over 86% of the time time the debtor does not respond to the suit within the 30 day time period; we then move for default judgment. On accounts we sue, we inevitably liquidate a very large percentage of those files as we already know what the debtor’s assets are. Therefore, we are able to levy bank accounts, garnish wages, lien real estate, and/or perform additional asset executions such as automobile repossession, etc.